RK Forgings

how global tariffs, supply chains, and demand cycles interact in the auto components industry, and how RK Forgings is navigating it.

Seeing Tariffs as a Punitive Measure from US

Tariffs – A Manageable Headwind

50% tariffs (steel/aluminium) apply globally – no exceptions. But for RKF, this hits mostly non-auto forgings (oil & gas), not its core auto components.

25% tariffs (auto components) apply universally except Mexico/Canada. This keeps a level playing field vs. competitors in Europe, China, etc.

RKF is passing on most of the tariff cost to customers, limiting margin impact.

Mexico acts as a tariff-bridge since 80% of RKF’s North American exports are routed there for finishing before entering the US.

Competitive Positioning

US lacks domestic forging capacity → dependency on imports continues despite tariffs.

No cheap alternative to India in forgings, making Indian suppliers like RKF sticky.

Competitiveness is not lost, since tariffs are globally uniform (ex-Mexico/Canada).

Demand Weakness vs. Supply Resilience

Biggest challenge: demand downturn (Class 8 truck orders at a 16-year low, medium-duty trucks at pandemic lows).

Supply chains are resilient – no evidence of US customers pulling orders or shifting supply away from India.

Customers are absorbing higher costs; tariffs don’t seem to be causing structural shifts, only cyclical slowdowns.

Diversification Strategy

Rather than new factories abroad, RKF is building new markets (Europe, SE Asia).

Goal: Europe business to equal/surpass North America in 8–12 quarters (~2–3 years).

This de-risks geographic concentration while leveraging India’s cost advantage.

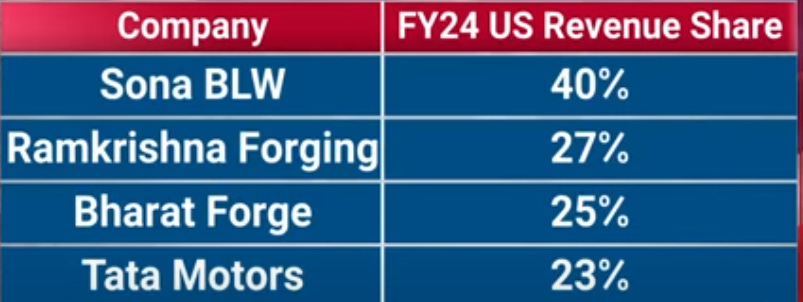

Auto and auto ancs with high US Exposures

Expect muted topline growth, pressure from weak US demand, but no structural order loss. Stock may look “stuck” until demand revives.

Revenue ramp from Europe + recovery in US trucking cycle → strong rebound.

RKF could emerge as a global forging leader, with balanced revenue mix (NA + EU + Asia).